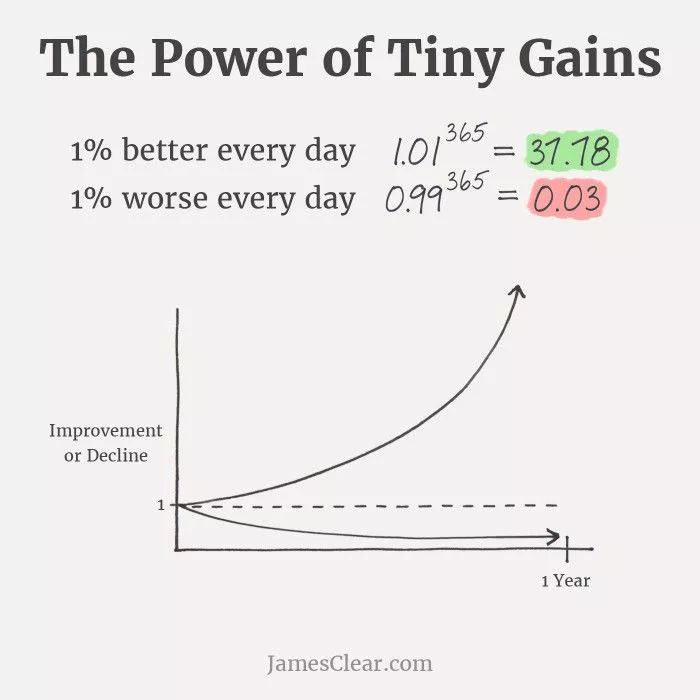

In August 2023, I opened my own LLC to run a fractional CTO/consulting business. After almost a year, I learned some important things that could be useful for people who would like to make a change in their career.

1. Never trust anyone unless the contract is signed and the invoice is paid.

As the title says, a potential client might be eager to work with you, but when it comes to the actual contract and work, they might suddenly disappear without any signs of life, even people with whom you thought you had a nice relationship. Lower your expectations to zero or sometimes below zero. Once the contract is signed and the invoice is paid, you can have a small relief. (This happened to me 9 out of 10 times, maybe something is wrong with me)